Non-market-linked investment options from 13Karat have the potential to yield returns twice as high as FD Savings

13Karat partners with RBI-registered P2P NBFCs to handle investor funds, allocating them to a hyper-diversified borrower pool, hence minimising risk.

Funds invested are in escrow accounts monitored by an RBI-regulated trustee.

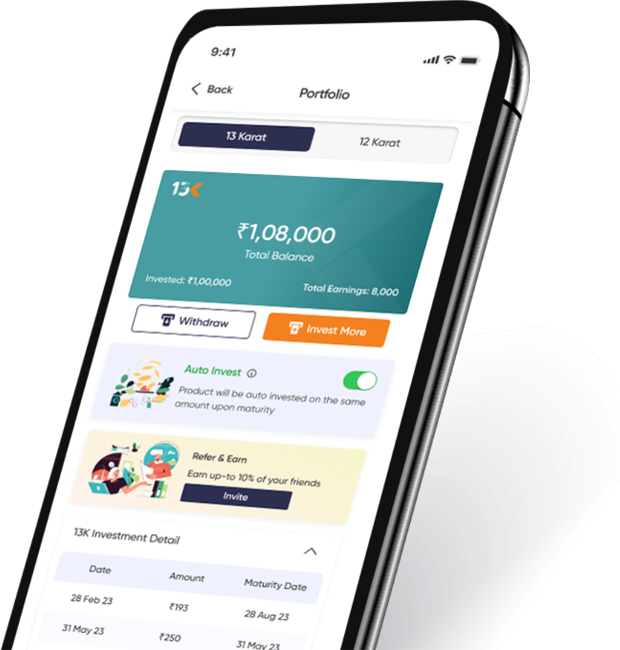

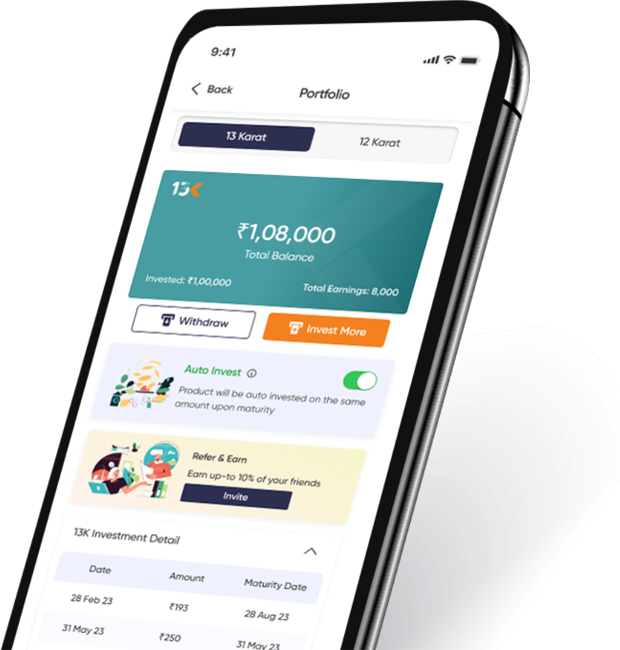

Complete wealth solutions at your fingertips.

Explore more on 13karat

13Karat is an Invest-Tech platform owned by Sqrrl Fintech Pvt. Ltd. It has entered into an agreement with RBI-registered P2P NBFCs, namely Lendbox and RupeeCircle, that have the necessary licenses to conducting Peer to Peer (P2P) lending activities. Through proprietary technological solutions, 13Karat streamlines the process of investing in the offerings of P2P NBFCs, allowing users to earn returns of up to 13% per annum potentially.

The funds invested through 13Karat will be deployed in the schemes of RBI-registered P2P NBFC, namely Lendbox and RupeeCircle. The invested amount will go to a hyper-diversified pool of borrowers sourced by these P2P NBFCs in terms of applicable RBI regulations.

Your money is only routed through the 13Karat investment platform and goes directly to the escrow bank account managed by an independent trustee appointed by RBI-regulated P2P NBFCs from where P2P NBFCs will use it to lend to the borrowers and cannot be accessed for any other purpose.

While we cannot guarantee returns like an oracle, our diligent analysis and assessments indicate that if a person invests and remains invested in the scheme(s) of P2P NBFCs for the specified duration, there is a promising probability of achieving returns of up to 13% p.a. However, this shall not be construed as any assurance or guarantee on the part of 13Karat, and investors shall carry out their own independent analysis or consult their advisors.