Tax Benefit Investment: Know about Section 80C Deductions

BLOG | April 11, 2024

When it comes to making a tax benefit investmentSection 80C is a tax-saving, section that was introduced by the Finance Act, 2005. Broadly speaking, this section provides a deduction from total income in respect of various investments/ expenditures/payments in respect of which tax rebate u/s 88 was earlier available. And while the Income Tax Act of India, 1981, contains more such tax-saving provisions, Section 80C is the most popular as it offers the most benefits.

Tax Benefit Investment – How much Income Tax can I save under Section 80C?

Deduction under this section is limited to up to a total of Rs. 1.50 lakhs only.

Learn all about Section 80C through the below video guide to save income tax

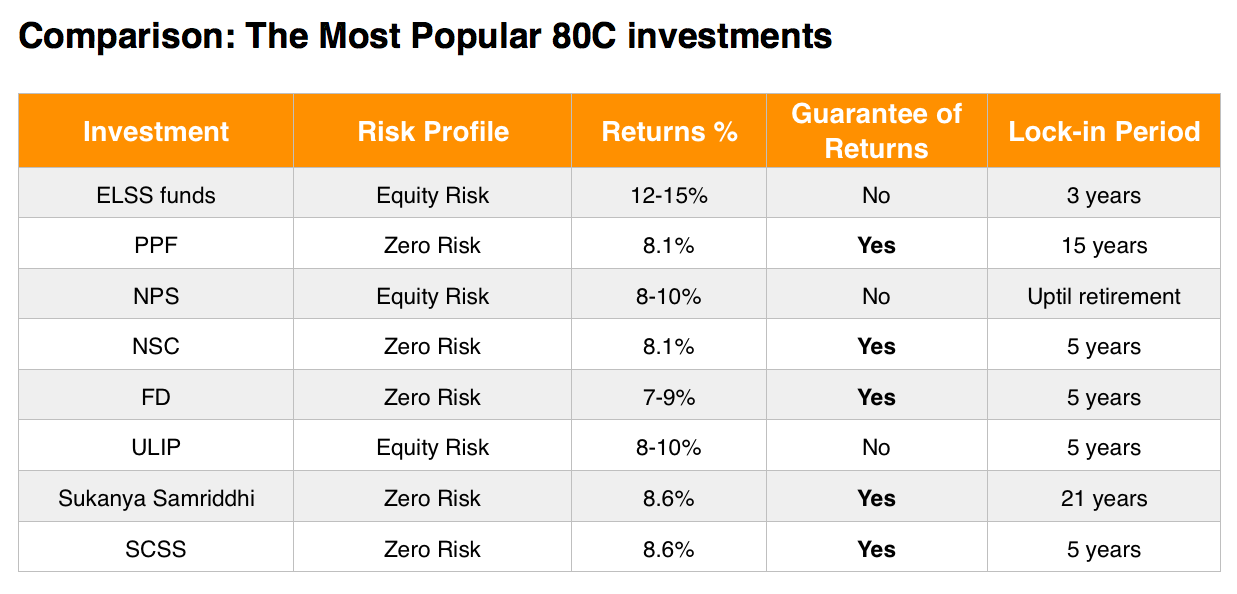

Equity Linked Savings Scheme or ELSS are tax saving mutual funds that are a popular example of a tax benefit investment. These funds invest a minimum of 65% of their assets in the stock market. You can earn an income tax rebate for investments up to Rs. 1.5 lakhs by investing in ELSS funds under Section 80C of the Income Tax Act.

In regard to the tax benefit investment duration, the lock-in period of ELSS funds is 3 years. It is the lowest among all tax-saving investments.

ELSS funds don’t offer guaranteed returns, but the past performance of these funds has given 12-15% returns thanks to the power of compounding interest.

ELSS funds are equity-oriented investments, hence all gains on your investments that are held for over one year are completely tax-free, a perfect example of a tax benefit investment.

(Click here to know how to invest in ELSS funds in 3 minutes with Sqrrl App

Click here to know about the best ELSS funds to invest in 2019

A public provident fund is one of the most used ways of income tax deductions under Section 80C – another example of a tax benefit investment. Deposits made in a PPF a/c are eligible for tax deductions under Section 80c for AY 2018-19. It is a saving as well as an investment scheme offered by the Government of India.

A PPF account has a lock-in tenure of 15 years. Withdrawals post 15 years are tax-free.

A PPF is a risk-free tax benefit investment and gives guaranteed interest. PPF investments are backed by the Finance Ministry for every FY. The current rate of interest is 7.9%, compounded annually. Returns from PPF are tax-free.

While you can’t withdraw money from your PPF account before its maturity, a user can take loans against their PPF account, depending upon the amount currently stored there.

Employee’s Provident fund allows for income tax deductions for salaried employees and falls under the Section 80C deductions list. The maximum investment for tax rebate allowed is Rs. 1.5 lakhs in a financial year. Under EPF both the employee and employer contribute 12% of your basic salary.

To avail the tax rebate, the funds must be locked in for a minimum of 5 years. You can make withdrawals at the time of retirement or at the time of changing jobs.

EPF offers returns based on the current interest rate which is 8.65%.

An EPF account can only be opened by a salaried individual. A tax Benefit investment done in EEP qualifies for deduction under Section 80C of the Indian Income Tax Act, 1961.

These are like regular fixed deposits, and allow for a person to have an income tax break under the Section 80C of the income tax act. The maximum benefit is Rs. 1.5 lakhs.

Tax saving FDs have a lock-in period of 5 years in terms of a tax benefit investment.

Different banks offer different rates of interest on such fixed deposits, but the interest generally ranges from 7-9%.

offer 100% protection of your capital and offer you compounded returns. However, the interest will be added to your taxable income post maturity.

NPS or the National Pension Scheme is a scheme by the Government of India. It allows the working professionals & people from the unorganized working sectors to have a pension post their retirement. It offers different plans and a subscriber can pick based on their risk horizon.

The money under NPS is locked until the time of retirement.

NPS does not offer you guaranteed returns, and the maximum exposure to equity investments is capped at 50%. The NPS returns upon the time of maturity are taxable, however.

The subscriber gets an option to change the dedicated pension fund managers. You can avail additional tax benefits by investing up to Rs. 50,000 in NPS for tax deductions under Section 80CCD(1B)

Another example of a tax benefit investment National Savings Certificates (NSC) allows for income tax deductions for the financial year in which they are purchased. Under Section 80C, investments up to Rs. 1.5 lakhs in NSCs can be used for an income tax rebate.

NSCs come with a lock-in period of 5 years.

While the 8% interest (current) is compounded annually, the returns are taxable.

You can purchase NSCs from a designated post office hassle-free.

Like other tax benefit investments – Unit Linked Insurance Plans or ULIPs are one of a kind investments. They are a mix of insurance and investment. A part of the investment amount is used to provide insurance to the investor and the other part is invested in the stock market. Again, investments up to Rs. 1.5 lakhs are valid for exemption under Section 80C. However, there is no clarity on the breakdown of investment or how much commission or expenses are charged on the investment amount.

ULIPs have a lock-in period of 5years .

Returns are not guaranteed. But since ULIPs are equity-linked, past performance has given returns in the range of< 5-10% .

The combination of insurance and investment offers multiple benefits to the user, which is unique amongst all Section 80C investments. Hence, a perfect tax benefit investment to try!

Another example of a tax benefit investment, the Sukanya Samriddhi Yojana account is also eligible for tax deductions up to Rs. 1.5 lakhs. The deposits have to be made for a girl child by the legal guardian or the parent of the girl child.

The lock-in period for the Sukanya Samriddhi Yojana account is 21 years. However, once the account holder turns 18, they can withdraw up to 50% of the previous year’s total balance.

The Sukanya Samriddhi Yojana is a government-backed scheme and offers guaranteed returns at 8.4%, compounded annually.

The interest and the receipts upon maturity are completely tax-free. The fact that it offers a stable financial future for the girl child makes it a very progressive and unique tax benefit investment.

Another popular tax benefit investment, SCSS or the Senior Citizens Savings Scheme is an exclusive scheme for people who are over 60 years old or people over 55 years old who’ve opted for voluntary retirement.

The lock-in period for this scheme is 5 years.

The SCSS is a risk-free investment offered by the government and offers 8.6% returns.

Senior citizens can avail of this scheme and invest up to Rs. 1.5 lakhs for tax deductions under Section 80C.

As you just saw, Section 80C has an exhaustive list of ways to save on taxes. And this makes planning taxes and claiming deductions, an extremely difficult task. Thus, to break these deductions into a simpler, easy to understand manner, certain subsections were introduced.

So, what are these 80C subsections?

Section 80CCCThe reason to include Section 80CCC was to encourage taxpayers to invest in pension funds and insurance schemes in order to make a tax benefit investment. It kicks in when you buy or continue annuity plans or retirement plans, of any insurance company. And can only be claimed for the year, in which the amount has been paid.

To explain this, let’s say you did not pay any premium to your pension fund for one year. But in the second year, you paid for both (the first and the second) years and now want to claim deductions for both the years. This is not possible. As per the rules, you cannot claim the deductions for the first year, since, under section 80CCC, deductions can only be claimed for the year in which the amount has been paid.

Few other things that need to be taken care of are,

Section 80CCD is particularly geared towards those contributions made towards the schemes notified by the Central government – National Pension Scheme (NPS) and Atal Pension Yojana (APY). Even Section 80CCD has been divided into two subsections:

Section 80CCD (1)Deductions under this section can be enjoyed by both salaried and non-salaried personnel. The only difference being salaried employees will be able to claim deductions up to 10% of the salary they get in-hand, while for self-employed individuals, the maximum deduction will be 10% of whatever they earn annually.

Section 80CCD (2)This part is focused on the employer’s contributions to the NPS scheme. Although the limit is again 10%, an employee can claim deductions for the same, in case his/her employer makes payment to the employee’s NPS account. For more details about Section, CCD deductions click here .

Section 80CCFSection 80CCF concerns long-term infrastructure bonds that have been notified by the central government and provides deductions for the subscription of the same. It was introduced in the budget of 2010 and came into effect in 2011. And due to this, investing in the fledgling infrastructure domain of India has come out as a really attractive proposition. The maximum deduction allowed under is 20,000.

Section 80CCGSection 80CCG allowed for deductions under Rajiv Gandhi Equity Savings Scheme (RGESS). Starting April 1st, 2018, this has been discontinued by the government.

Now that you have a lot of information on the fields where you could Axe Tax, now is the right time for you to save income tax. You can make a tax benefit investment right now with Sqrrl.

We’ve got the easiest way out for you. Download Sqrrl and invest in ELSS funds to save up to Rs 46,350 on Income Tax. All of this takes only a few minutes.

This is what you have to do.

Step 1 : Download Sqrrl by clicking here

Step 2 : Complete the 2-minute Signup Process (KYC verification), which is swift, secure and completely paperless!

Step 3 : Axe Tax with Sqrrl.

You can download Sqrrl by clicking here

We hope you are clear about tax benefit investment now. To invest, Download the Sqrrl app now.